Competing In the Wealth Management Marketplace for Ultra High New Worth Clients – Part 2 of 21/13/2020

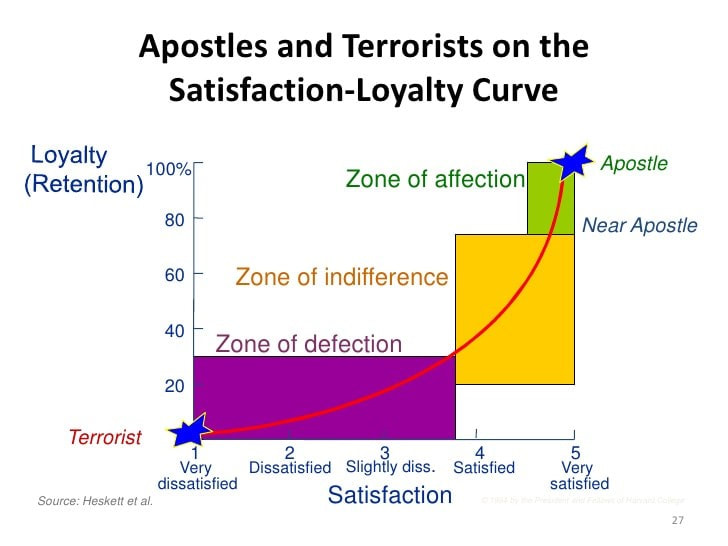

This is Part 2 of a two-part paper. The thesis of this paper is that from a technical solutions perspective, every true financial advisor / wealth manager is capable of providing all the solutions that UHNW and HNW clients want and need. Multi-family offices and boutiques do not likely have a leg up on you from this perspective. However, there is also an emotional perspective that has major influence on whether a prospect or client will do business with you. The majority of the decisions individuals make are based on emotion not on logic. This is the real challenge you must overcome to work with the HNW and UHNW investor. Loyalty and differentiation is a function of being extremely satisfied...”raving fans”[1] [1] https://hbr.org/2008/07/putting-the-service-profit-chain-to-work Emotional Solutions – The Harder Part

It has been suggested that 85% of decisions individuals make are based on emotion and they use the other 15% to logically justify those decisions. In fact, “Neuroscience Confirms We Buy on Emotion & Justify with Logic & yet We Sell to Mr. Rational & Ignore Mr. Intuitive.”[1] “Harvard Business School professor Gerald Zaltman says that 95% of our purchase decision making takes place subconsciously.”[2] “If it’s true that 95% of our purchase decisions take place unconsciously, then why are we not able to look back through our decision history, and find countless examples of emotional decisions? The answer is that our conscious mind will always make up reasons to justify our unconscious decisions. It does this to maintain the illusion that our conscious mind is in charge.”[3] So, what do specialty UHNW multi-family offices and boutique firms’ focus on to acquire your clients and prospects? Naturally, they must be able to offer the technical solutions you can offer or the client and prospect must believe they can. They probably can. What they are selling that is more difficult for wirehouses and some RIAs is often panache, “flamboyant confidence of style or manner.” That is, they may be better sales people and exhibit a confidence and style based on a set of experiences of having other UHNW clients select their firm. One of the first places the emotional aspects of building relationships takes place in the “intake” process. The “intake” process is used as an entry point for the technical solutions, e.g., wants and needs assessment for financial planning, risk and investment management, etc. It is also used as an entry point for the emotional solutions. The success of the “intake” process may well be you best opportunity to build and maintain a close relationship. Note that it was stated[4], “Almost 40% of customers worth over USD$4 million feel that their wealth manager neither understands their financial goals nor their product and service preferences.” In order to have the best opportunity for building a relationship with a prospect and retaining relationships with clients, there are at least five keys:

In Addition It is also possible competitors like multi-family offices and boutique firms’ could be “selling” their “flat” organization vs. a larger bureaucracy. There are advantages and disadvantages to both but no question that the resources needed are available from larger firms and there can be a confidence that if there are foul ups, larger, established firms have “deeper pockets.” Recognize that some people prefer being “bigger fish in smaller ponds.” That’s a tough objection to counter. However, you can talk about how you provide the solutions of a boutique firm within a larger franchise. A team can offer the true intimacy and personal attention of a boutique with large firm resources and you need to demonstrate how. Chances are however that these will be for your top 25 or so clients. You have to be selective to whom you will provide that personal attention to and what that attention is. If you are in retention mode, it will be important to recall the many conversations and the deep personal knowledge you have through a long history with the client. This is why the CAPS letter is so important. Existing relationships and having worked with a client over the years, takes a long time to replicate. For example, think about the challenges of rebuilding a relationship with a mentor, a religious counselor, a therapist, or a Primary Care Physician. Of course, some people become bored and when a knight on a white horse comes riding in they can appear to be saviors, whether true or not. Does the proverb “the grass is always greener on the other side of the fence” apply? At times it does. However, if you have a truly deep relationship with a client your odds of retention go up. Nevertheless, as “The Boss” sang, some people are “blinded by the light.” Another thing that may sell if a prospect has come into sudden wealth, a big “windfall”, they just may want to be a part of an “exclusive” firm with other UHNW people. They may want to be in an environment of “like” individuals financially with more perceived attention. It may be a feeling, it may be a networking opportunity, and it may seem like a better learning and social experience. It could just be ego. That may be enough. One benefit of multi-family offices and some boutique firms is that they likely have a lower or much lower client to advisor ratio so you get more attention and services. This is what some high-end cruise lines sell, lower guest to staff ratios. In many cases, the approach would be to discuss with a prospect that you will be working with a team of say four, five or six professionals who will provide the range of services you will be using from estate planning to tax planning to trust services to administrative services, etc. If you are an individual advisor you would do well to take a team approach even if it means sharing the client. Some multi-family offices or boutiques can also provide concierge service, e.g., capital purchases, special event and/or vacation access, etc. One question is, “How much time and special services does a firm provide a say $100MM client who may be paying $400K to $600K or more per year in fees?” “Other” Solutions – A Special Note of Experience As a senior, I have found a need for many medical specialists over the years. This includes gastroenterologists, pulmonologists, dermatologists, podiatrists, cardiologists, ophthalmologists, proctologists, urologists, nephrologists, internists, neurosurgeons, ophthalmic neurologists, neurologists, general surgeons, orthopedic surgeons and a couple other specialists. (And, I am relatively healthy.) What would it be worth to have a health coordinator who understands each of these specialties and could coordinate the delivery of health services to me? It would be a significant value if in fact they could coordinate services, make, and track appointments and next steps. Perhaps multi-family offices and boutique firms can provide that coordination or be what’s become known as a PCFO, Personal or Private Chief Financial Officer. For a small subset of key clients, you can do that as well. In addition to being a long-term financial professional, I am a husband, father and grandfather. I think about legacy and what it really means to me. Each of my children are in different financial situations though I have decided to treat them equally in my will. I do make other day-to-day decisions based on need (not want). However, I have thought long and hard about what legacy means for some other personal reasons and want to share them with you whether you work with “mere” millionaires, multi-millionaires or UHNW individuals. One of the things you can provide with all of your clients is discuss what legacy means to them. Legacy is not just about money. Legacy is more about values. Your actions, the way you live, think and act are all part of what you have been given by your ancestors as well as what you have learned about values throughout your life. What of your history, your beliefs, your values and your learning do you want to leave your descendants? Your ancestors gave you a legacy, some good and I suppose some bad. You are your descendant’s ancestors and your descendants are the ancestors of their descendants as you are. What do you really want to leave behind? As a financial advisor, you have an opportunity to discuss these things as part of your role. You can do this one-on-one, in a family meeting or both, if of course; your client is open and willing. I believe your clients will see value in such a discussion and it will be special. When my brother was dying earlier this year, he asked me, what do you think my legacy will be? It was a special time and a special question from my best friend who I loved dearly. He knew I loved him by what I wrote. There was no mention of money. Emotional Solutions – In Summary: We all know the 80/20 principle that indicates 80% of your profitability likely comes from 20% of your clients. Your book is probably more like 80/35 or so where 80% of your profitability likely comes from perhaps 35% of your clients. Interestingly, a perfect book might actually be 100/100 so 100% of your profitability comes from 100% of your clients and every client is profitable at your minimum desired rate of profitability. We recognize that some clients will be more profitable than others’ and those need even more “retention thinking” but all clients can be “worth” retaining. Assuming a solid base of clients in such a book, say 50 to 100 clients, the beauty of the 100/100 book is that the loss of any one client has less impact on the profitability of the firm and will not likely “tank” the firm’s profitability. Another advantage of such a book as that you can offer a very high level of common services to all your clients. In essence, that’s what high-end multi-family offices and boutique firms attempt to do. To be pragmatic, think about striving to be a firm with only two tiers of clients, highly profitable and profitable. This might be called a Platinum tier and a Platinum Plus tier. You will of course have a group of clients who are the children, family, important friends of your Platinum clients. These clients are “courtesy” clients where profitability is not a relevant metric. Their value is based on the value of the client that is your Platinum client though they will not likely need the same services you provide to their “parent” client. A Final Note I am paranoid about competition since my selling days. As Joseph Heller said in Catch-22, “Just because you're paranoid doesn't mean they aren't after you.” I believe many FAs would LOVE your best clients as much or more than you do. Therefore, you MUST be constantly be striving to be better because our marketplace is constantly changing, as are client wants and needs. Continue to reinvent yourself and as the overused corporate cliché goes, in the immortal words of Walter Gretzky, “Skate to where the puck is going, not where it has been.” As I titled a previous article, If it Ain’t Broke… Fix It Anyway! David I. Leo David Leo is Founder of Street Smart Research Group LLC. He is an author, speaker, coach, consultant and trainer to financial professionals. David is an experienced business manager who works solely with Financial Advisors, Planners and firms who want to organize, structure & grow their businesses by attracting, servicing, and retaining affluent clients. If you would like additional details or have any questions about his articles or an interest in coaching schedule a free 45 Minute Strategy Session @ https://calendly.com/davidileo or contact him @ [email protected]. Call 212-598-4229 (Office) or 917-379-1249 (Cell) and visit @ www.CoachDavidLeo.com. [1] http://customerthink.com/neuroscience-confirms-we-buy-on-emotion-justify-with-logic-yet-we-sell-to-mr-rational-ignore-mr-intuitive/ [2] Ibid. [3] Ibid. [4] http://www.scorpiopartnership.com/opinion/blog/client-experience-wealth-management/ Comments are closed.

|

Archives

June 2030

Categories |