|

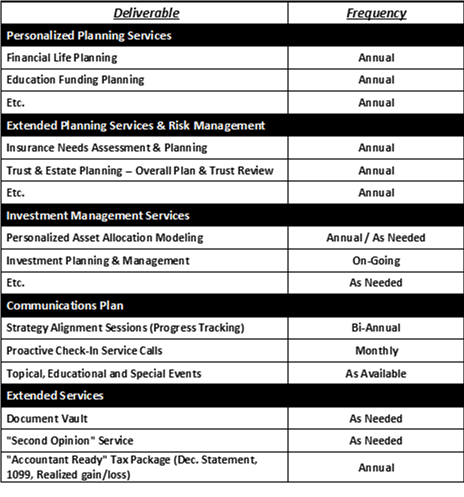

Perception Gaps Between FAs and Their Clients A business coach’s research recently reported there are potentially major issues facing many financial advisors today because there is a perception gap between what affluent clients think and what their financial advisors think. Gaps between clients and FAs can create serious problems if left unaddressed. Gap: Service Deliverables As the report stated, “there is a strong probability that your clients aren’t aware of the totality of the services you offer -- they still view you as you were when you first started working with them. The result is they don’t know your true capabilities.” This is likely true in general and specifically with regard to critical services such as financial planning. The problem is clients may look elsewhere for services they do not know you provide. Let’s first look at the general and discuss how to address this disconnect. It is important to share the breadth of your PROCESS and your Client Service PROMISES, your deliverables. An example of process is: This is what I call “The Six Core Client Facing Processes.” It’s about creating best of breed financial solutions to illustrate your commitment to providing high client satisfaction by focusing on an end-to-end set of processes that ensures consistent quality service delivery and the highest possible client experience. In addition, discuss the specifics of your deliverables, your services, a subset of which is illustrated below:

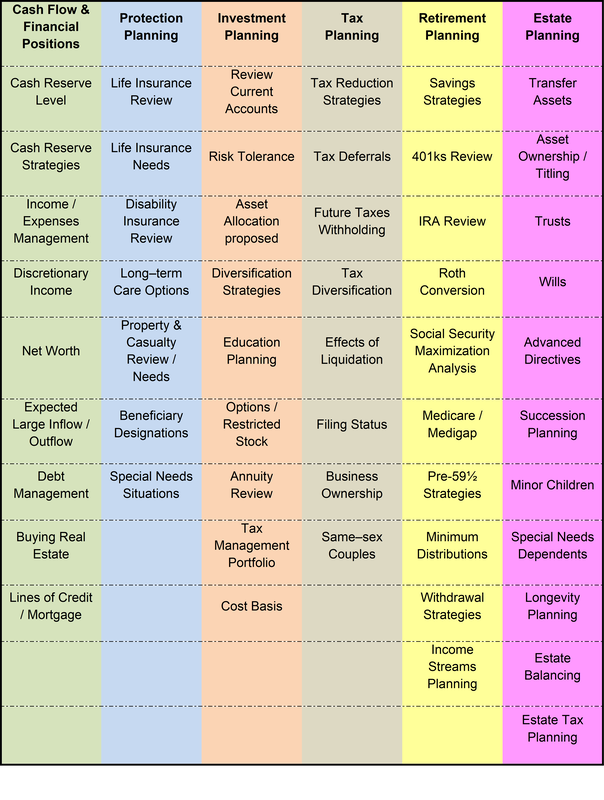

Gap: Core Deliverables, Financial Planning There are certain deliverables that are core to why a client may be doing business with you. We believe financial planning is one of those deliverables and that modern advisory practices steeped in wealth management must be based on high value financial planning services. In some cases, clients have left advisory practices to hire financial planners because while some practices tout financial planning, planning is not really their focus and more critically, their “financial plan” is not an active roadmap for the whole of the family’s financial affairs. To counter this perception gap:

The client may technically have a financial plan, but the client’s perception may be that the advisor only knows about investing. This is why we stress that you have a “financial planning based practice, a formal process and on-going reviews to incorporate life’s on-going realities.” The research done for the aforementioned firm stated, “74% of today’s affluent started their search (for a financial planner) because they didn’t think their current advisor was capable of handling their family’s wealth. This is the #1 reason affluent clients initiate a search for a new advisor. Only 9% began looking for a new advisor because they were unhappy with their current advisor.” In addition, “previous research asked affluent investors if they had a comprehensive financial plan they were following. In a parallel research project with financial advisors, they also asked if comprehensive financial planning was a core aspect of their practice. Three-quarters of advisors claimed to provide financial planning services, while (only) approximately 1/3 of affluent respondents said they had an actual financial plan they were following.” That is a potentially fatal disconnect. What do your clients think of your financial planning offerings? Gap: Relationship The research identified another serious perception gap regarding the affluent client-financial advisor relationship; another disconnect. Recent findings on this issue highlights the problem; “28% of affluent clients perceive to have a personal relationship beyond the professional level, compared to 68% of advisors reporting a personal relationship with their affluent clients. This huge gap regarding the perception of the relationship remains a challenge.” Interestingly, the affluent say “they want to know their advisor on a personal level. It’s a fundamental concern of trust. When clients have a personal relationship with their advisor, they are more likely to follow their advisor’s advice, appreciate the services provided, stimulate positive word-of-mouth-influence, are loyal, and introduce the advisor to business opportunities (prospects).” In asking advisors if they know nine things about their top clients such as their work, their education, their hobbies, if they know those client’s COIs, I have found advisors anecdotally know perhaps 50% to 60% of that information. This is another sign of a disconnect. We should also note that clients want to know their advisor on a personal level. Can they answer those same nine things about you? Do they know why you do what you do? Hopefully with the above they do know more about how you do what you do and what you do. Other Gaps: Disconnects Additional supportive research[1] also reveals differences in perspectives between advisors and their HNW clients. Some examples include:

The point of this paper is to suggest that advisors do not likely know as much as they think they know about their clients and it may be of value to be more open to sharing information about yourself to fully implement the know, like and trust aspects of relationships. Though there are a number of other disconnects between what clients and their advisors think, “According to The FPA Financial Planning Association in the United States[7], 85% of advisors do not have a formal feedback process. Similar research by Business Health Australia[8] 85% of advisors do not have a formal feedback process. The reason why not is likely that, up until now it has not been an important process for advisors. The top 15% who do feedback typically earn more than $200,000 more (up to 52% more) than advisors who do not have a formal feedback process.”[9] Start by learning more about your client’s want and needs as well as their values and interests. Let them know more about you. Begin your feedback process today even if it is an informal process. David I. Leo Practice Optimization Coach for Financial Advisors David Leo is Founder of Street Smart Research Group LLC. He is an author, speaker, coach, consultant and trainer to financial professionals. David is an experienced business manager who works solely with Financial Advisors, Planners and firms who want to organize, structure & grow their businesses by attracting, servicing, and retaining affluent clients. If you would like additional details or have any questions about his articles or an interest in coaching schedule a free 45 Minute Strategy Session @ https://calendly.com/davidileo or contact him @ [email protected]. Call 212-598-4229 (Office) or 917-379-1249 (Cell) and visit @ www.CoachDavidLeo.com [1] http://www.wealthmanagement.com/high-net-worth/disconnect-between-advisors-hnw-clients [2] https://www.oppenheimerfunds.com/private-client-groups/interactive/generations-project [3] https://www.thinkadvisor.com/2017/04/07/what-clients-want-and-what-advisors-think-they-wan/?slreturn=20180601220713 [4] https://www.iris.xyz/marketing/disconnect-between-what-rich-clients-want-vs-what-financial-advisors-say [5] https://www.cnbc.com/2016/04/04/facing-disconnect-between-investor-wants-advisor-deeds.html [6] https://philanthropynewsdigest.org/news/advisors-underestimate-wealthy-clients-philanthropic-goals-survey-finds [7] Source USA FPA Research and Practice Institute study - Future of Practice Management -December 2013 [8] Source Business Health Pty Ltd. 2013 US Advisors Key Value Drivers USA [9] https://www.advisorpracticemanagement.com/blog/post/feedback-is-critical-to-a-financial-advisor-practice-by-grant-hicks-cim |

Archives

June 2030

Categories |