Competing In the Wealth Management Marketplace for Ultra High New Worth Clients – Part 1 of 212/5/2019

This is Part 1 of a two-part paper. The thesis of this paper is that from a technical solutions perspective, every true financial advisor / wealth manager is capable of providing all the solutions that UHNW and HNW clients want and need. Multi-family offices and boutiques do not likely have a leg up on you from this perspective. However, there is also an emotional perspective that has major influence on whether a prospect or client will do business with you. The majority of the decisions individuals make are based on emotion not on logic. This is the real challenge you must overcome to work with the HNW and UHNW investor. Loyalty and differentiation is a function of being extremely satisfied...”raving fans”[1] [1] https://hbr.org/2008/07/putting-the-service-profit-chain-to-work In the Silicon Valley, it is not uncommon for executives of various firms and start-ups to be granted stock options as part of their compensation for investing themselves into new ventures which also turn out to be riskier situations than joining a more typical, stable, established organization.

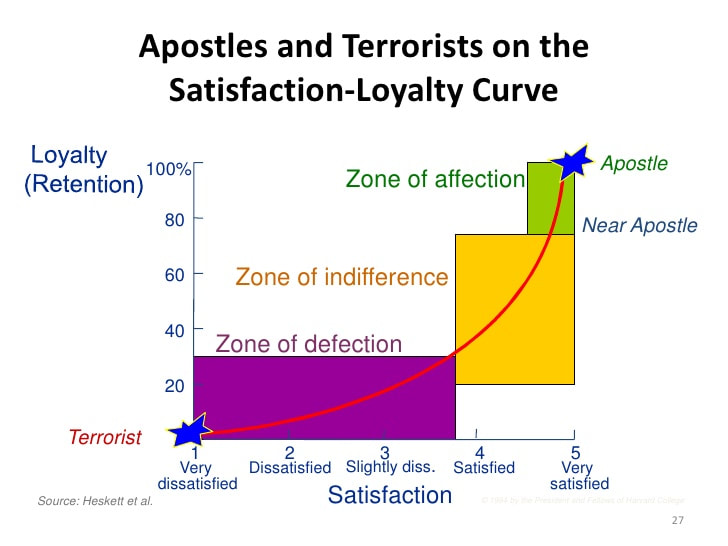

Some of these firms take off and become fantastic successes, e.g., Uber, Airbnb, Stripe, Pinterest, etc. A Forbes article stated that “that while it is commonly assumed that 90% of startups fail, this isn’t supported by the data. The numbers show that only 50% of startups fail -- those that are backed by venture capital firms (VCs) fair worse, failing 75% of the time. So, you already have a 50-50 chance of making it, which are pretty good odds in my book. Add to that an ability to execute well, and you will materially increase your chances.” Therefore, FAs in “the Valley” have clients that sometimes become “uber” wealthy as these situations turn into windfalls of perhaps tens of millions of dollars or more. In working with a client, we wanted to be prepared by understanding what services might be required or desired by newly minted UHNW clients so we could retain those clients after a windfall. It is obvious that many wealth management firms, including boutique firms and multi-family offices, focus on these situations and target these individuals. We should note that an existing relationship with a newly minted UHNW client and their current wealth management firm client might be highly satisfactory. This was the case in a recent situation on which we worked. In fact, the advisory team went to many lengths to ensure they were meeting both the client’s wants as well as their needs. The team maintained a solid relationship with both spouses and provided services to their adult children. They brought forward the range of services available from a world-leading provider of comprehensive wealth management and investment products and services for individuals and businesses. The team was always doing “retention thinking”© as we all must in competitive businesses. A term I have borrowed before and written about is the team went “beyond better sameness.” It is critical to point out that these services and the “retention thinking”© this team does is the kind of thinking every FA needs to do every day not only to “protect and serve” its client base against the occasional “attacks” by boutique firms that focus on UHNW clients but from every other wealth management firm that wants “your” clients in “their” book of business. What Do UHNW Clients Want? Once you have answered the question of what clients want, you can determine if you are delivering or can deliver on those wants and needs and identify any gaps in your offerings. The purpose of searching for potential gaps is to determine if and how you can be competitive with high-end multi-family offices and boutique competitors as well as all other wealth management firms that would like to acquire your clients and/or compete with you for high value prospects. Technical Solutions – The Easier Part Let’s start by understanding that you will not likely win a prospect’s business or retain a client’s business solely based on your technical solutions. Many of your competitors can provide at least the same level of products, technical services and solutions as you can. Having said that, you MUST still show your technical competence and the excellence of your products, technical services and solutions. Your minimum goal is not to lose the business because you have a technical or competence shortfall. You MUST also ensure your prospects and clients understand the full range of solutions you offer whether or not at any moment those solutions are wanted or needed. Having said this, your client and prospect interactions should only be 20% to 30% on the technical aspects of your relationship. As we will discuss later, you will win and retain the business because you provide high value products, technical services and solutions based on the emotional connections you MUST make with your prospects and clients. In my book, “The Financial Advisor’s Success Manual”, I discuss the core deliverables that can and likely should be offered to retail investors based on their value to the business. Each of these services can provide value to the client if they want and need them. However, I do not view these services as unique or able to differentiate an FA. What could differentiate an FA are client discussions of all the potential deliverables available to the client and discussing the value of each to the client. Solutions could include all or some combination of deliverables in the areas of:

There are few if any technical solutions that boutique firms and multi-family offices can deliver that wirehouses and quality RIAs cannot also deliver. Many firms will partner with other high value resources like tax attorneys, trust and estate attorneys, CPAs, insurance specialists and others. Even multi-family offices don’t keep all these experts on staff. Some larger RIAs do have multi-skilled staffs. Doing a modicum of research as represented by the articles and conversations with advisors asking the question “Are there any services potentially provided by boutique firms and multi-family high end competitors that cannot be effectively addressed by your organization?” Our answer at this point is no certainly from a technical perspective of products and services. We identified several elements that UHNW clients have identified as important to some of them. All of these elements can be addressed in the above laundry list. It is a matter of execution rather than these elements requiring any special skill a boutique firm or multi-family office might have.

While these are all important solutions and services, you can see there is no magical element that quality WM advisors cannot provide. The questions are what does each client want and need and can those wants and needs be delivered profitably. If not the advisor has additional decisions to make which has little to do with their technical capabilities. One recent article, “10 Strategies to Protect Ultra-High Net worth Family Wealth” (https://www.ktva.com/story/40907122/10-strategies-to-protect-ultra-high-net-worth-family-wealth) would have you offer:

Again, except perhaps Vacation Property Planning are all within the purview and capabilities of FAs serving most investors and are part of the core deliverables outlined. Another recent article “What Your High-Net-Worth Clients Want to Talk to You About” (https://www.thinkadvisor.com/2018/12/17/what-your-high-net-worth-clients-want-to-talk-to-y/) is on point and based on the 2018 U.S. Trust Insights On Wealth and Worth study, which surveyed nearly 900 respondents... The five topics these HNW individuals wanted to discuss more with their advisors:

Technical Solutions – In Summary:

David I. Leo David Leo is Founder of Street Smart Research Group LLC. He is an author, speaker, coach, consultant and trainer to financial professionals. David is an experienced business manager who works solely with Financial Advisors, Planners and firms who want to organize, structure & grow their businesses by attracting, servicing, and retaining affluent clients. If you would like additional details or have any questions about his articles or an interest in coaching schedule a free 45 Minute Strategy Session @ https://calendly.com/davidileo or contact him @ [email protected]. Call 212-598-4229 (Office) or 917-379-1249 (Cell) and visit @ www.CoachDavidLeo.com. |

Archives

June 2030

Categories |