|

Service offerings that were seen as premium yesterday may be considered ho-hum today. To keep your clients loyal and attract new business, you need to continually create “delight” with strategic updates. Central asset accounts were first announced 30 years ago and quickly became a source of “delight” for the investors whose advisors introduced this service to them. Here was something new and exciting—service that not every investor was getting. The value was tangible. Then time passed. More and more advisors started featuring them, and it became a competitive disadvantage not to offer central asset accounts. This cycle—where a novel client offering gradually becomes expected, and then quite possibly taken for granted as a basic requirement—happens with most client service innovations. So being aware of the realities of how your services are perceived and updating them accordingly is vital to keeping client loyalty and attracting new clients. The value of pursuing client loyalty in the first place There is much supporting data that shows marketing to existing clients is significantly less expensive than marketing to potential clients. Cross-selling is also much more likely with existing clients than when selling to new clients. Retention, or loyal clients, can be defined as clients who conduct business with only you now and plan to conduct business with only you in the future. In addition, they are very interested in considering new strategies, services, and solutions you recommend while resisting the “pull” from your competition. They also provide solicited and unsolicited referrals. Client loyalty and retention are based on client satisfaction. The VIP Forum of the Corporate Executive Board states that:

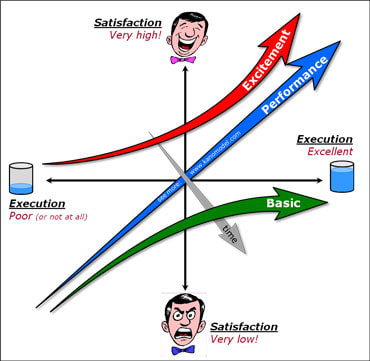

The point is that mere satisfaction is likely not enough to allow advisors to reach lofty goals. And, extremely importantly, delivering satisfaction and therefore gaining loyalty is a process and a strategy, not a onetime event. The issue in financial services, as in other industries, is that this has to be displayed on a continuing basis; contact after contact, opportunity after opportunity, and month, quarter, and year after month, quarter, and year. In terms of adding value, you have to go beyond the core value of the client’s expectations. I can tell you from working with advisors that it is vital to work on your core values, like rational investment planning and execution, 100% accuracy, timely and regular contact, and so forth. These are expected and no longer the base for client loyalty or retention. You must also express strengths of investment expertise, experience, education, integrity, performance standards, and caring. These capabilities are also expected and no longer the base for client retention. Although we make sure solid deliverables are in place, these skills, capabilities, and values do not differentiate advisors from many of the other 400,000 or so financial professionals competing with them. All advisors at least claim all these characteristics. The Kano model Dr. Noriaki Kano, a leading client satisfaction researcher, developed a model that speaks to this challenge of adding client value. This model of client satisfaction, and hence loyalty, predicts that the degree of client satisfaction is dependent upon the degree of need fulfillment but is different for different types of client expectations. Dr. Kano’s model can be seen at http://www.kanomodel.com/. Expected (Basic)

Expected requirements are so obvious to clients that they do not state them overtly as requirements. When these requirements are met, the client says nothing and probably doesn’t even notice. When these features or services are not present, the client complains. Continually improving on meeting these kinds of needs will not elicit client loyalty or delight. Example: The telephone dial tone Normal (Performance) These are “fundamental” to quality delivery. Clients overtly state these needs and are very aware of them. When these needs are met, clients are satisfied. When they are not met, clients are dissatisfied. For many types of requirements in this category, it is possible to deliver more than client requirements and generate additional perceived benefit. Example: Performance reporting It is important to note that deliverables such as estate planning, education planning, tax advantaged strategies, financial/retirement planning, and, as stated above, central asset accounts, etc., are at this point in time non-differentiated services. Most advisors and virtually all significant advisory firms preach and teach these as standard deliverables. Delightful (Excitement) Clients have needs of which they are not aware. These are referred to as “latent” needs. They are real, but not yet in most clients’ awareness. If these needs are not met by a provider, there is no negative client response. They are not dissatisfied, because the need is unknown to them. If a provider understands such a need and fulfills it, the client is rapidly delighted, as in the case of central asset accounts in the late 1970s. Example: 3M PostIt Notes when first introduced (notice they are now considered a basic office supply!) The future of delight As suggested above, sources of excitement when first introduced tend to become expected as the market becomes familiar and saturated with them. That which delighted the client yesterday becomes a basic expectation as competition makes it an undifferentiated service. “Delighting” the client and increasing their loyalty takes more and more effort, and cost, over time. A question remains as to what could be the latent client demands that will delight them and provide a differentiated solution. Based on my work, I see at least three possibilities. One possibility is a function of poor execution on the part of some of today’s industry participants. Two other opportunities relate to enhanced services, financial and non-financial. ‘Walk the talk’—Improved execution One possibility for delighting the client is in consistently and continuously “walking the talk” rather than just “talking the talk.” One example is to establish a “daily game plan” for each client that varies based on the client’s value to the advisor’s business. That value involves more than assets and revenues and is established based on relationship, potential, and other factors. We establish a minimum number of face-to-face meetings per client, a minimum number of telephone-based portfolio reviews per client, and a minimum number of check-in calls per client. Every meeting has an agenda and goal, and every face-to-face meeting solicits feedback and introductions, if appropriate. There is much evidence that there is still a lot of “talking the talk” versus “walking the talk” in service delivery. We understand that the level of delivery that will meet and exceed client expectations calls for a new delivery and cost paradigm. This leads us to a discussion of enhanced services, financial and non-financial. Enhanced financial services Given constantly growing client expectations and competition from many sources, one of the newer possibilities for delighting the client is a whole new set of financial services that are a “facsimile” of family office services for clients with perhaps $1 million to $5 million or even up to $10 million or more in assets under management. Such services could include:

These are an exemplary subset of the types of services that family offices for the ultra-wealthy already provide. Many questions remain, such as:

Enhanced non-financial services Such services could include:

These are also an exemplary subset of the types of services that family offices for the ultra-wealthy also provide. Many questions remain, such as:

The next step will be to determine which clients or prospects will value which services. As Wayne Dyer said, “There is no scarcity of opportunity to make a living at what you love to do, there is only a scarcity of resolve to make it happen.” Execution is critical, because a small advantage will make a large difference in results. Sam Silverstein’s “Law of Fractional Advantage” states that all you need to do to win at anything is to be slightly better than your competition. “We don’t have a problem knowing what we should do. The problem is that we just don’t do it! ” note authors Steve Levinson and Pete Greider in their book "Following Through: A Revolutionary New Model for Finishing Whatever You Start." Remember

A parting thought or two: “Well, in OUR country,” said Alice, still panting a little, you’d generally get to somewhere else—if you ran very fast for a long time, as we’ve been doing.” “A slow sort of country! said the Queen. Now, HERE, you see, it takes all the running YOU can do, to keep in the same place. If you want to get somewhere else, you must run at least twice as fast as that!” —Lewis Carroll, Alice’s Adventures in Wonderland And also remember this observation: The heights by great men reached and kept Were not obtained by sudden flight, But they, while their companions slept, Were toiling upward in the night. —Henry Wadsworth Longfellow David I. Leo Practice Optimization Coach for Financial Advisors David Leo is Founder of Street Smart Research Group LLC. He is an author, speaker, coach, consultant and trainer to financial professionals. David is an experienced business manager who works solely with Financial Advisors, Planners and firms who want to organize, structure and grow their businesses by attracting, servicing, and retaining affluent clients. If you would like additional details or have any questions about his articles or an interest in coaching schedule a free 45 Minute Strategy Session @ https://calendly.com/davidileo or contact him @ [email protected]. Call 212-598-4229 (Office) or 917-379-1249 (Cell) and visit @ www.CoachDavidLeo.com |

Archives

June 2030

Categories |