|

“Time is free, but it’s priceless. You can’t own it, but you can use it. You can’t keep it, but you can spend it. Once you’ve lost it you can never get it back.” -- Harvey Mackay Client loyalty, retention and growth are critical to practice success. Each client loyalty component can bring value to the client and value to the practice in terms of retention and growth. It also costs you (and your team) time. You need to be in balance for an efficient and effective financial advisory practice. How do you balance costs and benefits? Most financial advisors determine general client profitability by client based on their revenue. Fewer financial advisors have measured their time and costs for servicing their clients by tier. Practice profitability can of course be measured in aggregate. Few FAs “know” where they are spending their time and costs and whether the time and costs are being appropriately invested in the “right” clients based on their profitability. Consider your time, value, and knowledge.

Estimate the cost of delivering services to clients by tier. Improve your client servicing costs by determining what may be restricting time for business growth and calculating advisor contact workload.

Part of the costing process is determining how much time you can and want to devote to each major task. Here’s how to do it in 6 steps:

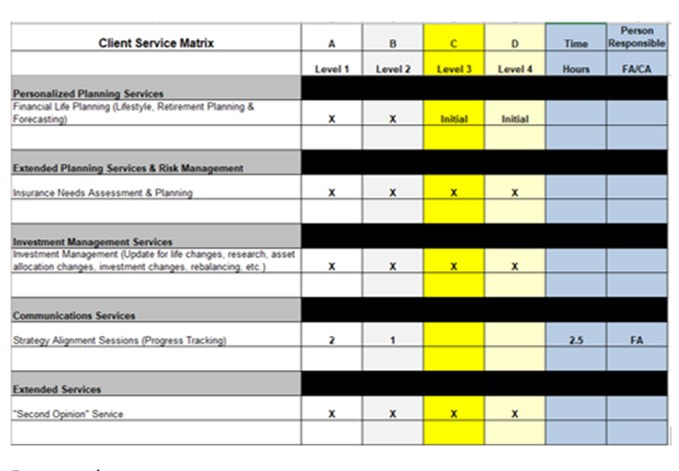

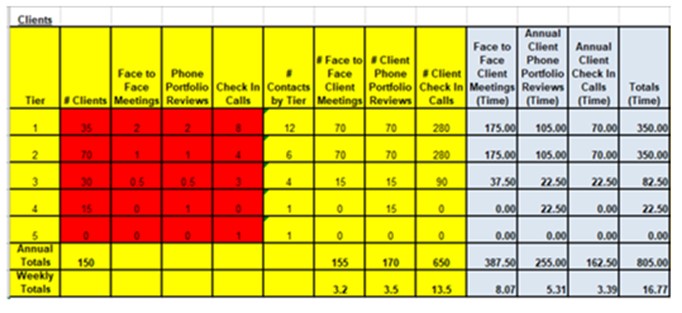

This table and spreadsheet takes explanation but in summary, using a set of assumptions on numbers of contacts by tier, type of contact and time per contact type, you can see 35 Tier 1 clients will require 350 hours of advisor contact time per year or 10 hours per client per year at $500 per hour or $5,000 per year of advisor cost. These data are exemplary, does not consider CA offload at lower hourly costs or variations in individual client requirements.

What are the next steps? Determine how much time you spend on other services for clients by tier and the other tasks in your business: asset/investment management (estimated at $2,000 / Tier 1 client), any other client service/relationship management services, team management (estimated at $1,000 / client), and assumedly other activities. In addition, there are emails and inbound phone calls. Similar techniques can be applied to each of these other FA business activities. The point here is to organize and structure your business as best you can based on the realities of your current book of business, your team, an effective and efficient set of roles and responsibilities, your business plan, and the goals your plan includes. David I. Leo, The Cost of Loyalty Snippet 5 David Leo is Founder of Street Smart Research Group LLC. He is an author, speaker, coach, consultant, and trainer to financial professionals. David is an experienced business manager who works solely with Financial Advisors, Planners and firms who want to organize, structure & grow their businesses by attracting, servicing, and retaining affluent clients. If you have questions or would like assistance in personalizing and implementing approaches from The Financial Advisor’s Success Manual, schedule a free 45 Minute Strategy Session at https://calendly.com/davidileo or contact me at David@CoachDavidLeo.com or visit my website at www.CoachDavidLeo.com My book is available at Amazon at https://www.amazon.com/Financial-Advisors-Success-Manual-Structure/dp/0814439136 Comments are closed.

|

Archives

June 2030

Categories |