|

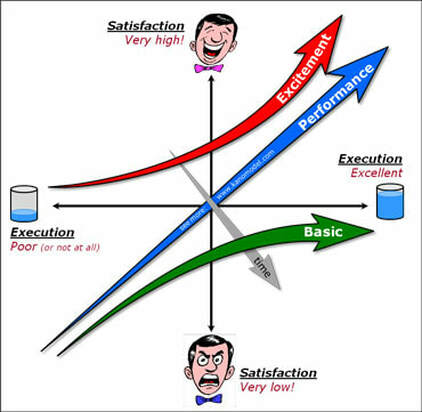

ESCAPE SAMENESS An old business friend, Frank Capek, coined an expression “Beyond Better Sameness.” While there has been increasing attention and spending to improve client experiences, Capek said that change has been slow to come to the retail brokerage industry. For example, financial planning itself has an almost five-decade history. Forms of technology have been used for financial planning for perhaps 40 years or more. However, as Michael Kitces says, “For much of its history, financial planning software was basically just an elaborate calculator. Advisors could gather client data, feed it as input to the calculator tool, and the software would spit out the projected results…which were then used to facilitate the sale of a product.” Financial planning is evolving, however, and as Kitces says, “has increasingly become a tool for real-time collaborative scenario planning.” While financial planning tools have improved significantly, the purpose and quantitative aspects of offerings have not changed dramatically. The qualitative side of the process has changed, and is changing with an increased focus on the emotional needs of clients and their families, such as how they see living the next 20, 30 or more years in retirement. From a service perspective, advisor’s primary deliverables relate to financial planning, estate planning, insurance, various communications services from in-person meetings to phone calls to mailings as well as various administrative functions. Some advisors provide education-funding solutions and banking services (in the case of a broker, if they are part of the broker-dealer or alternative offerings). A few firms offer “personalized” investment policy statements. These can even be developed using technology. Some advisors offer technology solutions that scan and upload pertinent family documents in a secure encrypted online vault that allows controlled access for family members and advisors. Estate planning documents, insurance and banking documents, contracts of any kind and supporting paperwork can be stored and retrieved safely and securely. However, most of what wealth managers are providing today do not significantly change the state of services offered to clients or differentiate an advisor. The reason that is so critical is seen in the “Kano model”. It says that over time, client expectations grow such that what once excited clients becomes everyday service expectations, and eventually become so basic that clients only notice them when they are missing. With growing client expectations and very a competitive marketplace, financial advisors must continue to seek more and better ways to differentiate themselves, i.e., “beyond better sameness,” such as prettier reports or improved credit card offerings. Certainly, excellent and consistent delivery of the above mentioned services are critical. However, there must be services that advisors can offer that are needed and/or wanted by individual investors and that have the potential to differentiate by adding significant value where and when needed. In other words, to keep your clients loyal and attract new business, you need to continually create “delight” with strategic updates that excite or re-excite the client. Kano suggests some of these services are “latent” client demands. In other words, in some cases clients may not yet recognize these services as being wanted or needed, i.e., you may be “ahead of the curve” – a leader, which could be a differentiator.

What are examples of services advisors can provide that could “delight” clients and provide differentiation? Along with your capabilities, other professionals can provide special services to your clients that can address critical life issues and involve finances. You can build a professional network of “vetted strategic partners” to help your best clients. Strategic relationships go well beyond, “I have a guy” and provide support in areas such as: Educational services:

Family and healthcare services:

Legal, tax and accounting and administrative services:

Emotional services:

Living services:

Many of these services as well as your current primary deliverables can and should be “personalized” for your best clients. A client advisory council can help you identify and prioritize services of value to your best clients, yet only a relatively small percentage of advisors conduct these councils. If you are fortunate enough to be in a niche-based practice, some of the above services will have more or less relevance to your niche. This is a critical part of your offer analysis. Delivering services such as those above require business decisions as to what, who, how and when to provide them. It involves costs, whether delivered by the advisor or a member of her or his team or “virtual team.” The virtual team can include “vetted strategic partners” with whom you have a personal and business relationship and to whom you can introduce potential clients and who can introduce potential clients to you. Costs would be incurred as a function of the:

Known costs needed to be addressed by one of several means including but not limited to:

As Guy Kawasaki said, you have to “jump to the next curve. Big wins happen when you go beyond better sameness.” In addition, as Wayne Dyer said, “There is no scarcity of opportunity to make a living at what you love to do; there is only a scarcity of resolve to make it happen.” It’s your resolve that will result in jumping to the next curve where you will find yourself special. If you want to improve your business by exploring ways to create new levels of client service, “signature experiences” if you will, make an appointment on my calendar to discuss if and how I can help you. David I. Leo David Leo is Founder of Street Smart Research Group LLC. He is an author, speaker, coach, consultant and trainer to financial professionals. David is an experienced business manager who works solely with Financial Advisors, Planners and firms who want to organize, structure & grow their businesses by attracting, servicing, and retaining affluent clients. If you would like additional details or have any questions about his articles or an interest in coaching schedule a free 45 Minute Strategy Session @ https://calendly.com/davidileo or contact him @ David@CoachDavidLeo.com. Call 212-598-4229 (Office) or 917-379-1249 (Cell) and visit @ www.CoachDavidLeo.com Comments are closed.

|

Archives

June 2030

Categories |